The Coordination Engine of Crypto

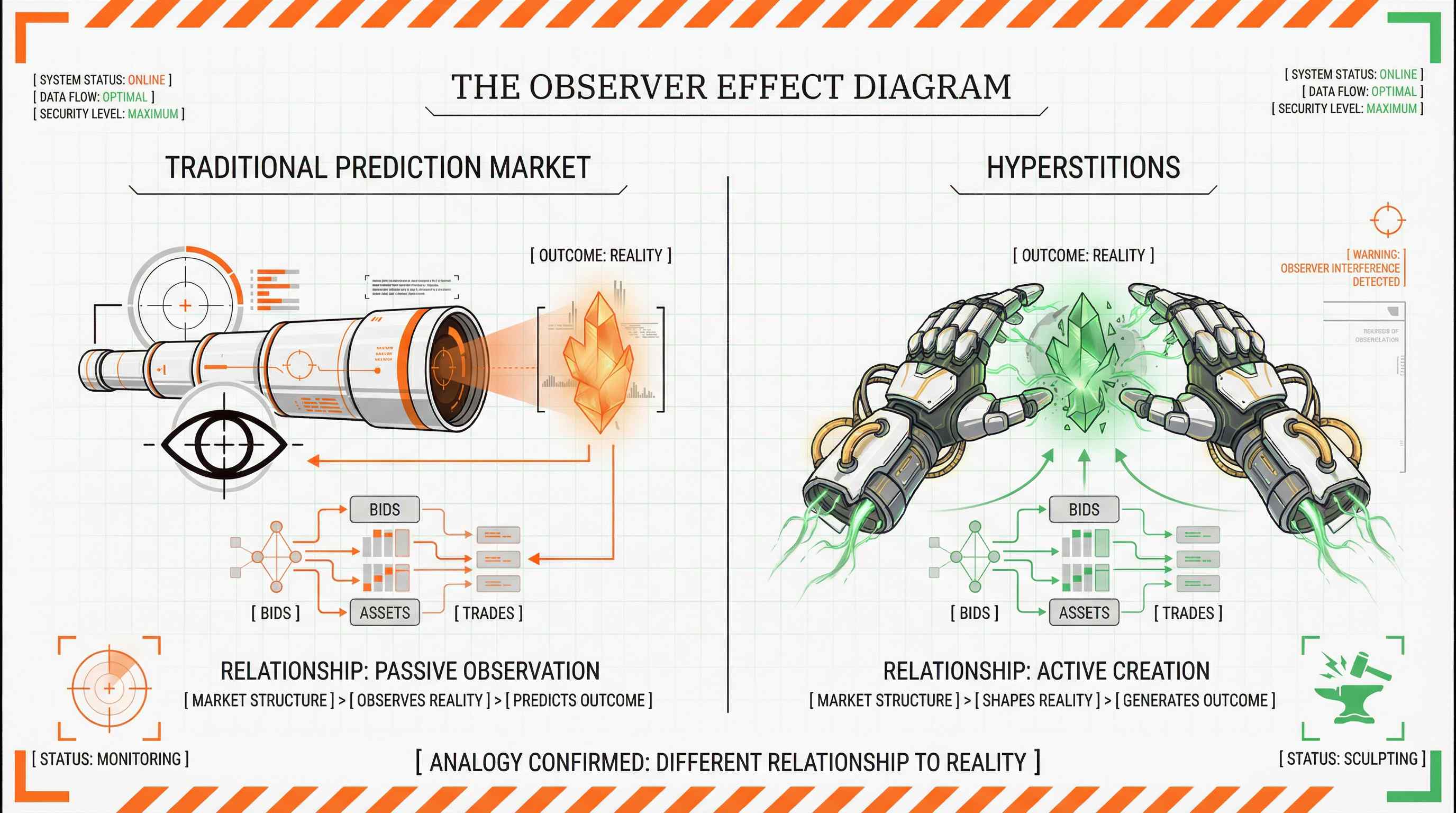

Polymarket proved markets shape outcomes. But those markets are passive observers—they aggregate predictions, they don’t mobilize action.

We’re building the active version. Reflexivity becomes the core feature, weaponized to manufacture the future.

[ TL;DR ]

Bitcoin is a hyperstition. People believed it had value, so it acquired value, so more people believed. We’re building infrastructure for intentional hyperstitions.

[ Hyperstitional Cycles ]

- 30% TVL increase sustained for 1 hour

- An analytics dashboard gets built

- A major influencer mentions the product

- A new feature ships by end of quarter

How It Works

Example: TVL Growth

| Cycle | Subsidy | Result | Learning |

|---|---|---|---|

| 01 | $20K | [NO] — 18% increase | Community is willing, needs more incentive |

| 02 | $25K | [NO] — 27% increase | Threshold is near, push harder |

| 03 | $30K | [YES] — 34% sustained | Coordinators profit from bet + appreciation |

Why Alignment Matters

[ How We’re Different ]

Passive speculators

Token holder voters

Private info sellers

Active coordinators

Bet on outcome

Bet on policy impact

Bet to reveal alpha

Buy + Bet + Build

Public

Public

Private (sponsor)

Public

Info aggregation

Policy selection

Info discovery

Coordination

Accurate prediction

Policy chosen

Sponsor gets alpha

Outcome manifested

| Traditional PM | Futarchy | Opportunity Mkts | Hyperstitions | |

|---|---|---|---|---|

| Participants | Passive speculators | Token holder voters | Private info sellers | Active coordinators |

| Action | Bet on outcome | Bet on policy impact | Bet to reveal alpha | Buy + Bet + Build |

| Price Visibility | Public | Public | Private (sponsor) | Public |

| Mechanism | Info aggregation | Policy selection | Info discovery | Coordination |

| Outcome | Accurate prediction | Policy chosen | Sponsor gets alpha | Outcome manifested |

[ PAMM ]

[ Phases ]

[ Exploration ]

We prove the mechanism across diverse market types using $HST as the coordination token.

Markets include:

- “Will $HST hit X FDV?”

- “Will X KOL post about $HST in the next 6 hours?”

- “Will protocol TVL exceed Y for Z hours?”

- “Will $HST reach top 3 of Kaito Info Markets leaderboard?”

- “Will $HST reach $10M volume in the next 8 hours?”

Cycle durations vary by market type. Because we use virtual liquidity, we can create short time windows—hours rather than days or weeks—while maintaining continuous price discovery. The cycle system remains: incentives scale over time as coordination momentum builds.

During Exploration, we partner with chains and protocols to create related markets, using their tokens as additional incentives.

All $HST trading fees are used to buy back $HST. Bought tokens are sent to treasury.

[ Crypto Coordination Layer ]

A few months away

Fully permissionless. Anyone can:

- Create coordination markets for any outcome

- Launch new tokens using Hyperstitions as the base layer

- Import any ERC-20 and add coordination mechanics

Hyperstitions becomes the coordination layer for crypto.

[ Tokenomics ]

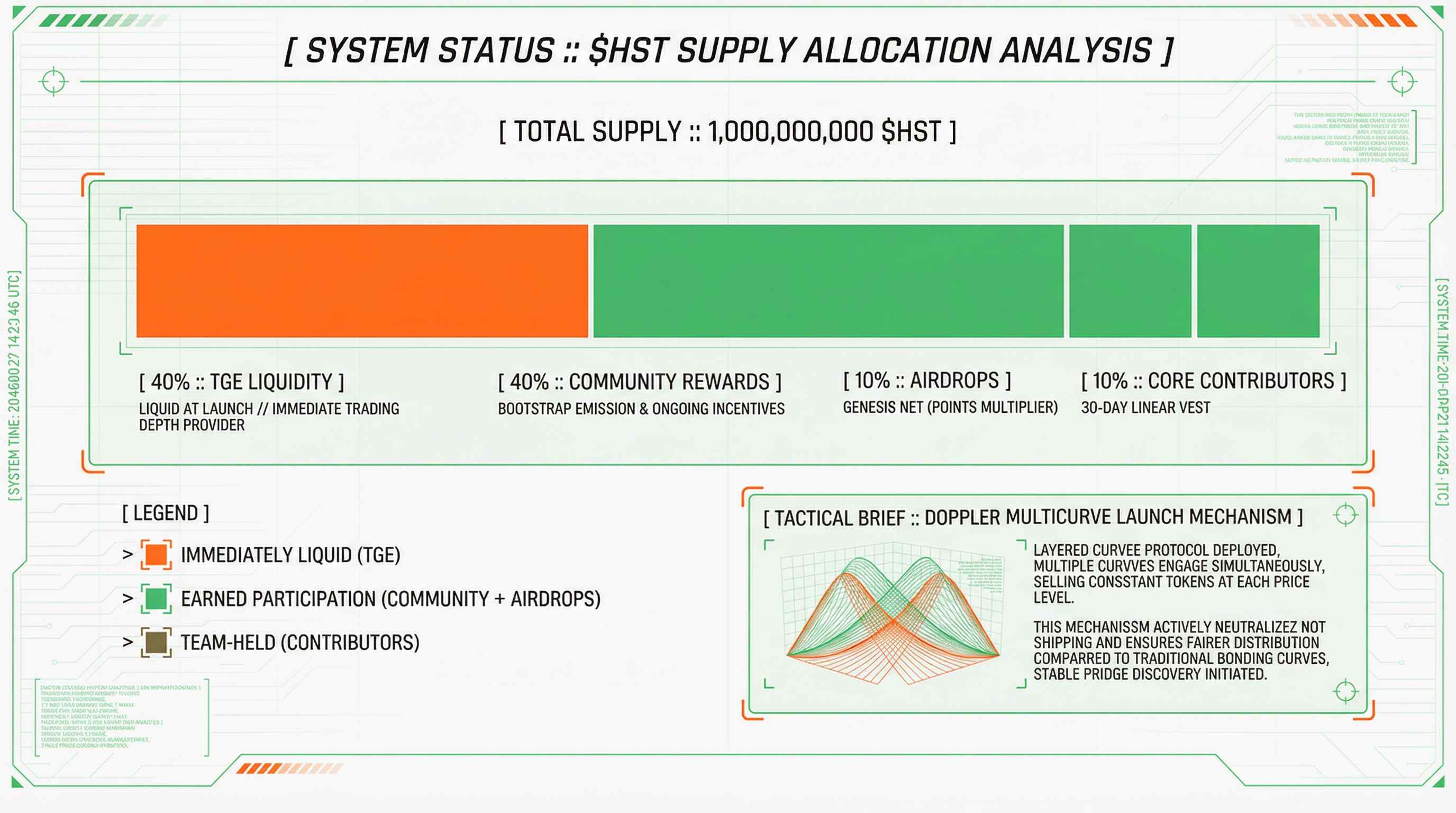

Total Supply: 1B $HST

| Allocation | % | Notes |

|---|---|---|

| TGE Liquidity | 40% | Liquid at launch |

| Community Rewards | 40% | Emissions + incentives |

| Airdrops | 10% | Strategic onboarding |

| Core Contributors | 10% | 30-day linear vest |